WCPS finds $1.3 million to use toward reducing $5 million deficit

The Wayne County school district remains more than $5 million in debt, but officials say they will pay off $1.3 million of that negative balance this month.

Once that payment is made, the district will cut siginificantly into the $2 million owed to the state Department of Public Instruction. (DPI is currently charging the district a monthly 1-percent interest rate on the balance owed, costing the district thousands of dollars each month.)

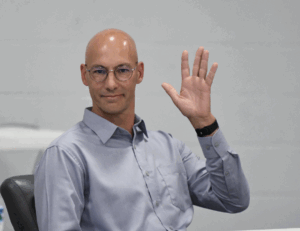

“That’s like a credit card,” said Adam Scepurek of the audit firm Anderson Smith & Wike, PLLC, who presented the district’s 2020-21 audit at the board’s meeting Monday.

Paying off that loan, which the district received in June, and retiring an additional $3 million owed to the district’s School Nutrition Fund, should be the district’s top priority, Scepurek said.

“Anytime you have a negative balance, you are required to budget to repay that balance,” he said.

Board members will see the debt on the books for a number of years before the district’s fund balance moves in a positive direction, Scepurek added.

“This is going to take time,” he said.

The numbers in the report were no surprise — Scepurek presented a preliminary report at the board’s December meeting.

The district had originally budgeted a $300,000 payment for this school year. But during his firm’s work with new chief finance officer, Leslie Rouse, Scepurek said he and budget consultant Aaron Beaulieu uncovered a fund associated with the district’s self-funded dental insurance program that had a $1 million balance, which did not need to be there and could be reappropriated to the debt repayment.

Moving the $1 million, which had been accumulating for about 20 years, did not damage the insurance program or put employee claims in danger of not being paid, the auditor said.

Scepurek said the unnecessary dental insurance reserve was just one of several oversights by the district’s previous finance officer and the district’s previous auditor, Rives & Associates, LLP, that contributed to the district’s budget problems.

Also cited was not reconciling fund balances, which resulted in some large overages that contributed to the district’s negative fund balance as well as an appropriation error that skewed a district account.

Moving forward, Scepurek said Rouse will monitor the accounts and will note overspending and suggest budget amendments accordingly while providing monthly updates for the board. By addressing overages in major accounts before they get out of hand, Rouse will be able to keep the budget in line and let board members know if there is a concern.

“If you do an accurate budget every year, you aren’t going to have to worry about going over budget until the last few months of the year,” Scepurek said.

The auditor said he is pleased with the district’s plans to mitigate the debt, which include monitoring spending and making cuts where appropriate.

“There has been a lot of work put in figuring out where all these issues lie and how these financial statements should be structured,” he said.

But he added that care would need to be taken in preparing next year’s numbers.

“Your budget needs to be accurate and truly reflect your financial situation,” he said. “The question becomes what are (your) expenditures really going to be.”

Scepurek added that there is still room in the district’s budget to find funds to retire more of the debt.

Rouse, in her report to the board, mentioned that there are still some unknowns as the district prepares its 2021-22 budget — COVID funding, although the district has been notified that it will receive $24.8 million from the state’s federal allotment (to be spent over the next 27 months), with more expected when the federal COVID relief bill passes Congress; the state and local allotments; as well as revenues from fines and forfeitures, which are trending down.

Acting Superintendent Dr. David Lewis said the district is optimistic about the district’s financial health.

“I don’t think this is the last debt repayment we will make this year,” Lewis said.

A loaded discussion

Fighting for their lives

Goldsboro loses a giant

“I’m a flippin’ hurricane!”

Public Notices — Feb. 8, 2026

Belting it out

Legendary

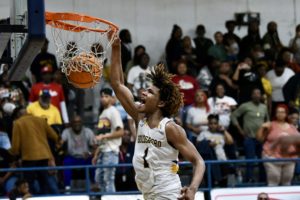

Final Four!