State Auditor reports significant violations in Mount Olive Water Department, at town’s airport

A damning report published Thursday by the North Carolina Office of the State Auditor paints Mount Olive as a, at best, poorly run town marred by shoddy bookkeeping practices, financial mismanagement, negligent employees who might be guilty of embezzlement and/or fraud, more than $200,000 in lost revenue, potential revenue that cannot be accounted for, and chaos at the town’s airport.

But officials from the NCOSA acknowledged that those issues could be simply the tip of the iceberg, as the office only investigated a handful of claims, departments, and practices.

The report also provides clarity into the early February admission, by Mayor Dr. J. Jermone Newton, that a State Bureau of Investigation probe had been launched as a result of “possible misconduct” among town employees, who were later identified by town officials as Tia Best and Rashonte Pettit, both of whom worked for the Water Department.

And it reflects the latest problem for a town board that has been bombarded, for months, by local residents about the lack of a resolution to its sewer moratorium — and criticized by State Rep. John Bell for squandering millions of dollars in allocations to get the situation under control.

“My biggest concern is, here it is, once again we’re helping Mount Olive. They have received millions upon millions of dollars to fix their issue, but it’s up to the Town Board to get it done,” Bell told Wayne Week earlier this year. “We have helped Mount Olive numerous times. It’s time for Mount Olive to fix its issues. And it’s time for everyone in the town to hold that board accountable. No more excuses. Their issues are a direct result of mismanagement. They have mismanaged millions of dollars. It’s been going on for years.”

The following is a word-for-word transcript of the NCOSA “Investigative Report.”

It has not been edited:

WHY WE CONDUCTED THIS REPORT

The North Carolina Office of the State Auditor (OSA) received allegations via the State Auditor’s Tipline regarding the Town of Mount Olive (Town), the Mount Olive Water Department (Water Department), and the Mount Olive Municipal Airport (Airport). During the investigation, OSA received an additional allegation regarding a Town Hall employee who did not accurately record the hours she worked on her timesheet. During the investigation, additional items were discovered requiring to be reported that were not directly related to the objectives.

OBJECTIVES

• Determine whether the Town misdirected tourism tax revenue intended for the Wayne County Chamber of Commerce.

• Determine if the Town has been paying Wi-Fi and telephone expenses for the Airport which the airport operator (Airport Operator) was responsible for paying.

• Determine if a sitting Town Commissioner received water service despite failing to pay for it.

• Determine whether employees of the Water Department committed fraud by failing to pay their water bills and voiding late charges for themselves and others.

• Determine whether an employee working at Town Hall accurately recorded the hours she worked on her timesheet.

WHAT WE FOUND

• There is no evidence the Town misappropriated tourism tax revenue from the Wayne County Chamber of Commerce.

• Verification of Wi-Fi and telephone services at the airport could not be made due to the Town’s records being so severely mismanaged and in conflict with documentation from service providers.

• The Town bears the financial burden of providing fuel at the Airport, even though it is the Airport Operator who is contractually obligated to purchase and sell the fuel.

• The Town’s Airport Operator extends credit on the Town’s behalf for fuel purchases.

• The Town’s Finance Director lacks a process to verify monthly fuel commission invoices from the Airport Operator, creating a risk of overpayment.

• The Town’s Finance Director did not include all checks in the Town’s accounting system.

• A sitting Town Commissioner failed to pay his utility bill for several months, yet his water service was not disconnected.

• In 2024, hundreds of water cutoff fees were voided monthly. This includes cutoff fees for two employees of the Water Department who failed to pay their utility bills and manipulated the system so their water service was not disconnected.

• The Town’s utility rates were improperly entered into the Town’s utility system and resulted in over $210,000 in lost revenue to the Town.

• The Town lacks policies and procedures governing the authorization of timesheets for hourly employees.

RECOMMENDATIONS

Town of Mount Olive Municipal Airport

1. Town officials review all Wi-Fi expenses dating back to the beginning of the Contract and recoup any amounts that should have been paid by the Airport Operator.

2. Town officials review contracts and payments with the internet service provider to determine what their financial obligation is.

3. Town officials review all telephone expenses dating back to the beginning of the Contract and recoup any amounts that should have been paid by the Airport Operator.

4. The Town determine who authorized automatic withdrawals from one of its bank accounts for the payment of fuel.

5. The Town ensure banking activity and contracts are only conducted by authorized officials.

6. The Airport Operator immediately cease extending fuel credit on the Town’s behalf.

7. All future fuel purchases are made by the Airport Operator.

8. The Town’s Finance Director ensure that all parties receive their correct fuel sales commissions.

9. The Finance Director document the Town’s financial activity in a timely manner.

10. A clear purchase control system be established for both the Town and airport.

11. The Town’s Finance Director and Airport Operator have regular monthly meetings to review airport expenses.

12. The Airport Operator provide the Town with semi-annual reports on expenses and costs.

Town of Mount Olive Water Department

13. To reduce the risk of future fraud, OSA recommends that the Town develop and implement policies and procedures regarding voided cutoff fees and proper segregation of duties.

14. The Town should develop and implement proper controls to ensure that rate information is correctly entered in the Town’s utility system.

Employee Timesheets

15. The Town should develop and implement policies and procedures related to the review and approval of employee timesheets, including, but not limited to, who is responsible for reviewing timesheets and how their review is documented.

Background: Town of Mount Olive, Mount Olive Municipal Airport, Mount Olive Water Department

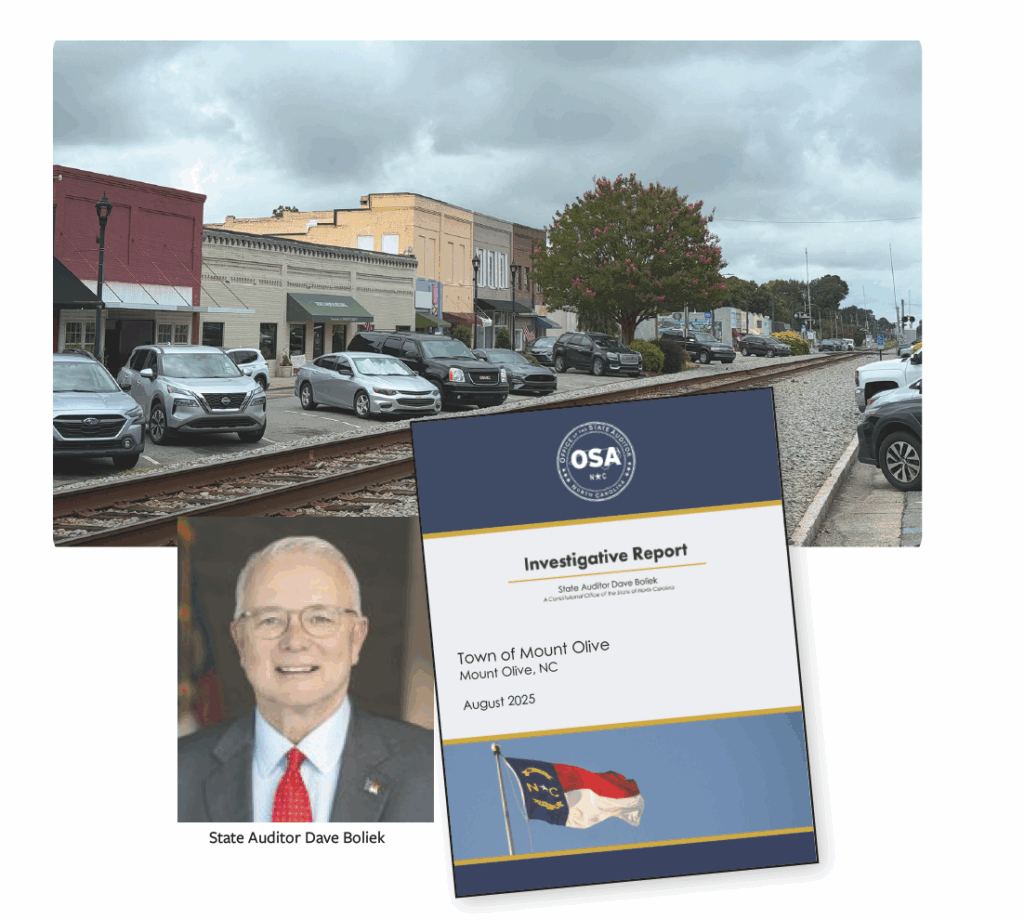

Town of Mount Olive

The Town of Mount Olive (Town) is located in Wayne County, North Carolina, and has a population of approximately 4,200 residents.1 The Town is governed by an elected Mayor and an elected Board of Commissioners (Board) consisting of five Commissioners. The Town Manager is appointed by the Board and is the chief administrator of the Town.

Mount Olive Municipal Airport

The Mount Olive Municipal Airport (Airport) is owned by the Town and managed by a third-party operator (Airport Operator) pursuant to a contract between the Town and the Airport Operator. While the Airport can accommodate larger corporate aircraft, it cannot accommodate commercial aircraft.

Mount Olive Water Department

The Mount Olive Water Department (Water Department) is operated by the Town. This Department provides water and sewer service to both residential and commercial customers within the Town, as well as portions of Duplin and Wayne Counties.

Tourism Tax Revenue: Allegation Unsubstantiated

Background

We received an allegation that the Town misdirected tourism tax revenue intended for the Wayne County Chamber of Commerce.

Session Law 2015-255 authorized Wayne County (County) to levy a one- percent room occupancy tax on rental accommodations at hotels, motels, and inns within the County. Upon collecting the tax, the County remits the revenue to the Wayne County Tourism Development Authority (Authority). The Authority uses the revenue to promote tourism in the County.

According to an agreement entered between the Town and the County in August 2015, the Authority holds all revenue generated by the occupancy tax until requested for use.

Investigation Finding

Based on our review, the Town does not have direct access to the tourism tax revenue; therefore, we determined the allegation to be unsubstantiated.

Town of Mount Olive Municipal Airport

Mismanagement of Town Records, Contract and Accounting Practices Inadequate, Purchases Improperly Authorized, Contracts Not Followed

Background

We received an allegation that the Town has been paying Wi-Fi and telephone expenses for the Airport which the airport operator (Airport Operator) was responsible for paying.

The Town entered a ten-year contract (Contract) with the Airport Operator in 2017. The Contract was updated in 2021 and again signed by the Airport Operator.

According to the Contract, the Airport Operator is an independent contractor and is solely responsible for the management and operation of the Airport. During calendar year 2024, the Town paid the Airport Operator $38,523 for the management and operation of the airport.

Summary of Findings

Our review sought to determine if the Town had been paying expenses for the Airport which the Airport Operator was responsible for paying pursuant to the Contract.

We found that Town records were unverifiable; contract and accounting practices for Wi-Fi, telephone, and fuel were inadequate; fuel purchases were improperly authorized by someone outside the Town; and both the Town and Airport Operator failed to follow their Contract. All of this puts the Town at a greater risk of fraud and/or embezzlement and leads to difficulty tracking financial activity.

Investigation Findings: Wi-Fi and Telephone Services

The Contract states clearly that the Airport Operator is responsible for providing telephone and Wi-Fi services at the Airport, but even though the Airport Operator signed the Contract twice, he still claimed to be unaware of his obligation to pay the Airport’s telephone and Wi-Fi expenses.

We attempted to review all telephone and Wi-Fi expenses related to the Airport for the period January through December 2024 to determine whether the Airport Operator was paying for Wi-Fi and telephone; however, the records maintained by the Town were unverifiable.

Wi-Fi

Wi-Fi service was billed to the Town — not the Airport Operator — between 2017-2024.

To determine whether the Town was being properly reimbursed by the Airport Operator for this service, OSA examined records from the service provider. During the period January to September 2024, the Town received $300 monthly payments for Wi-Fi reimbursement from the Airport Operator;2 however, the Town’s Finance Director informed us that the Town had not paid the monthly Wi-Fi bill due to a dispute with the internet service provider, except for a $10,000 lump sum payment in September 2024. According to records provided by the internet service provider, this payment was not credited to the Town’s account.

Overall, OSA was unable to determine what amount the Airport Operator was financially obligated to pay monthly due to conflicting billing statements as well as multiple contracts existing between the Town and the service provider.

Telephone

Telephone service was billed to the Town – not the Airport Operator – between 2017-2024.

The Town’s Finance Director was unable to explain telephone charges on the billing statements in the possession of the Town. OSA spoke with the Airport Operator regarding the telephone charges, and he confirmed the phone bills were in Town’s name. The Airport Operator told OSA that he did not believe he should pay for monthly phone service at the Airport and had only gotten service in his name following questions he received from the Town’s Board.3

Records from the telephone provider for calendar year 2024 show seven different phone numbers listed on billing statements. Only two of the phone numbers were attributable to the Airport. OSA was unable to determine what entity the other five belonged to. Further, the billing statements indicate internet service was provided by the telephone provider to two separate internet addresses, one to the Town’s wastewater facility, and the other to the Airport Operator.

Because of monthly fluctuations in billing amounts shown on the statements; billing statements for several months including past due balances and late charges and fees; and account adjustments and credits without explanation, OSA was unable to determine what amount was due monthly for telephone service at the Airport.

Investigation Findings: Aviation Fuel

While investigating Wi-Fi and telephone services, OSA came across items of attention related to aviation fuel purchases. The Contract indicates that the Airport Operator is responsible for the purchase and sale of all aviation fuel and is to receive a commission for fuel sold at the Airport. The commission amount was to be mutually agreed upon, but prior to the investigation no formal documentation existed specifying the amount he was to receive.

After OSA began its investigation, the Town and the Airport Operator signed an addendum to the Contract which stated that they had a previous verbal agreement that the Airport Operator would be paid 30% of the profits generated from the sale of fuel while the Town would retain the remaining 70% of the profits.

According to the Airport Operator, he orders the fuel and the Town’s Airport fuel bank account is debited for the purchase (OSA confirmed that fuel purchases were debited from a Town bank account). As per the Contract, however, it is the responsibility of the Airport Operator — not the Town — to purchase the fuel. Moreover, it was the Airport Operator — not representatives from the Town – who signed the contract with the fuel provider. It is unclear why and how a Town bank account is being debited for fuel purchases related to a contract that the Town is not party to.

Regarding fuel purchases by customers, the Airport Operator told OSA he only accepts credit cards. If customers do not pay via credit card, they can still obtain fuel without making a payment that day. Customers are invoiced for payment at a later date. For those customers invoiced, the Airport Operator emails the Town Clerk not the Finance Director – monthly to inform her whom and how much to invoice.

These invoices are not entered into the Town’s accounting system and therefore are not properly accounted for. This puts the Town at risk of losing money due to late or uncollectable payments.

Finally, OSA learned the Airport Operator invoices the Town monthly for his fuel sales commission and includes supporting documentation. While meeting with the Town’s Finance Director, it became apparent to OSA that she did not fully understand the supporting documentation and did not have a process to confirm the invoiced amount was accurate.

To determine whether the Airport Operator was invoicing the Town the 30% fuel sales commission, we reviewed all fuel sales during calendar year 2024. We found the Town paid the Airport Operator 31% commission. OSA is reasonably assured that the 1% difference occurred due to timing differences in accounting reconciliation – not any fault of the Airport Operator.

As per the Contract, it is the responsibility of the Airport Operator to purchase and sell fuel. The Airport Operator should purchase and sell the fuel and then remit 70% of the fuel profit to the Town.

Additional Finding

While reviewing the fuel sales commission paid to the Airport Operator during calendar year 2024, OSA found that the Town’s Finance Director did not enter all of the fuel sales commission checks in the Town’s accounting system. Specifically, as of December 31, 2024, the Finance Director had only recorded three of the ten checks paid to the Airport Operator in calendar year 2024.

The Finance Director’s failure to record checks in the Town’s accounting system put the Town at risk of fraud and/or embezzlement. Incomplete financial records make it difficult to reconcile transactions and potentially allow financial irregularities to go unnoticed. As a result, Town officials do not have all financial information available to them to make important decisions on behalf of the Town.

We Recommend the Following:

1. Town officials review all Wi-Fi expenses dating back to the beginning of the Contract and recoup any amounts that should have been paid by the Airport Operator.

2. Town officials review contracts and payments with the internet service provider to determine what their financial obligation is.

3. Town officials review all telephone expenses dating back to the beginning of the Contract and recoup any amounts that should have been paid by the Airport Operator.

4. The Town determine who authorized automatic withdrawals from one of its bank accounts for the payment of fuel.

5. The Town ensure banking activity and contracts are only conducted by authorized officials.

6. The Airport Operator immediately cease extending fuel credit on the Town’s behalf.

7. All future fuel purchases are made by the Airport Operator.

8. The Town’s Finance Director ensure that all parties receive their correct fuel sales commissions.

9. The Finance Director document the Town’s financial activity in a timely manner.

10. A clear purchase control system be established for both the Town and airport.

11. The Town’s Finance Director and Airport Operator have regular monthly meetings to review airport expenses.

12. The Airport Operator provide the Town with semi-annual reports on expenses and costs.

Town of Mount Olive Water Department: Fraudulent Activity, Water Rates Negligently Entered, Town Lost $210,837 in Revenue

Background

We received an allegation that a sitting Town Commissioner received water service despite failing to pay for it, and that employees of the Town’s Water Department committed fraud by failing to pay their water bills and voiding late charges for themselves and others.

According to the Town’s utility ordinance, if a customer fails to pay their monthly utility bill, a $100 cutoff fee will be added to their utilities account and their water service will be disconnected. Each month, the Town’s utility system generates a report listing customers who have failed to pay their utility bill. The Town’s Water Department reviews this report and can manually void the $100 cutoff fee. Doing so keeps customers off the cutoff list and continues their water service.

We found that the Town lacked formal policies and procedures for utility billing; data entry was performed negligently; and oversight during the implementation of utility rate increases was inadequate. These deficiencies increase the risk of billing errors, reduce accountability, and hinder the Town’s ability to ensure accurate utility revenue tracking.

Investigation Findings: Non-Payment of Bills and Voided Late Fees

OSA reviewed the Mayor’s and current Town Commissioners’ utility payment history for calendar year 2024. This investigation revealed that one Commissioner had his $100 cutoff fee voided nine times throughout the year. Further, the Commissioner did not make a single payment on his utility bill until August 2024 – when OSA received the allegation – at which point his outstanding balance was $942.

The below chart shows the account balance increase throughout 2024 until the allegation was received in August 2024. At that point, the Commissioner paid the utility bill in full. After August 2024, the Commissioner’s payment history remained inconsistent through March 2025.

During our investigation, we found the same Commissioner had another utility account for a different address which was closed in January 2024; however, the account had an unpaid balance of $342 as of March 2025.

While reviewing this allegation, OSA discovered that each month the Town’s Water Department voided hundreds of cutoff fees. The chart illustrates that in 2024, the Water Department Supervisor (Supervisor) voided 1,838 (86%) cutoff fees and charged only 291 (14%) cutoff fees. There was no documented reason for the voided fees listed in the Town’s utility system.

Fraudulent Activity

During calendar year 2024, the Supervisor fraudulently voided cutoff fees for her own utility account in 11 of 12 months. Additionally, she voided cutoff fees for the Town’s Water Department billing clerk (Billing Clerk) in 9 of 12 months. As a result of the voided cutoff fees, both individuals continued to receive water service despite not paying their utility bills.

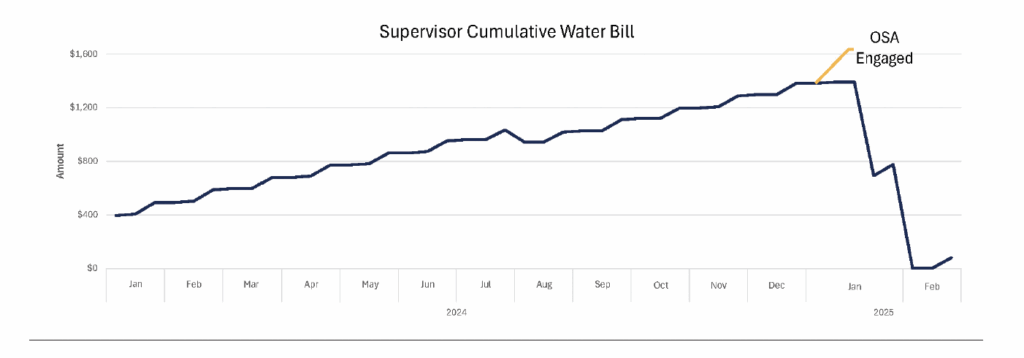

As illustrated in the below chart, the Supervisor did not make a payment on her utilities account until August 2024, when she paid $100, despite her account balance exceeding $1,000. By the end of 2024, her balance had increased to $1,381. As the debt accumulated, the Supervisor’s water service continued, and she was never charged the $100 cutoff fee. The Town suspended the Supervisor in January 2025 and terminated her in March 2025. She paid her utility bill in full in February 2025.

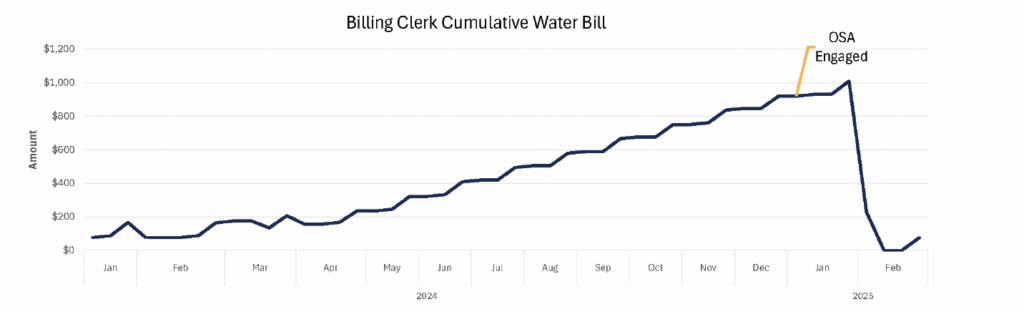

Regarding the Billing Clerk, the chart below illustrates while some payments were made on her utility account, she also accumulated debt throughout the year. Similar to the Supervisor, her $100 cutoff fees were voided while she continued to receive water services.

By December 2024, her balance had grown to $920. The Town suspended the Billing Clerk in January 2025 and terminated her in March 2025. She paid her utility bill in full in February 2025.

After this discovery, OSA investigated additional Town employees, including the Interim Town Manager, the former Town Manager, the Finance Director, the Town Clerk, and other Water Department employees. We determined that none of these individuals had utility cutoff fees voided during calendar year 2024.

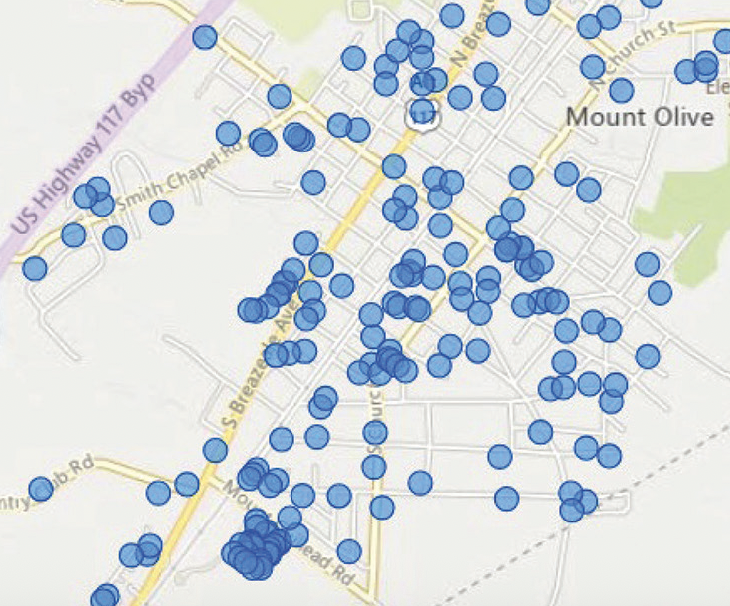

The below map shows households that had their $100 cutoff fee voided from April 15, 2024 through May 15, 2024.

The voided cutoff fee issue occurred because of the intentional actions of the Supervisor and a lack of policies and procedures related to utility billing.

Based on OSA’s review, the allegation is substantiated.

Investigation Regarding Water and Sewer Rates

While reviewing the allegation regarding voided water cutoff fees, OSA found that due to negligent data entry and lack of oversight, the Town grossly undercharged customers for water and sewer usage and lost revenue. This negligence and lack of oversight continued in March 2025, when an attempt to correct the data entry errors resulted in some customers being grossly overcharged.

In October 2023, the Town’s Board increased utility rates which included increases to water and sewer rates for residential and commercial accounts. While some rates were entered correctly, several were not.

Commercial Water Rates

Both the minimum and maximum water charge was set at the same rate, meaning that commercial accounts were billed the minimum base charge amount regardless of their actual water usage.

For commercial accounts inside city limits, customers were not charged more than $16.40 a month for water usage, regardless of how much water they used.

For commercial accounts outside city limits, customers were not charged more than $32.78 a month for water usage, regardless of how much water they used.

In August 2024, the Town’s Board approved another increase to utility rates, which again included increases to water rates for commercial accounts.

For this increase, both the minimum and maximum water charges were negligently entered, as follows:

• For commercial accounts inside city limits, customers were not charged more than $16.89 a month for water usage, regardless of how much water they used.

• For commercial accounts outside city limits, customers were not charged more than $33.76 a month for water usage, regardless of how much water they used.

For example: Business A paid an average of $1,211 for water service from July to September 2023, but from July to September 2024, it paid an average of $17 for water service – a difference of $1,194 per month.

Additional Utility Issues

A review of all the Town’s utility rates effective August 2024 identified that as of May 2025, there were a total of five usage rates (including the two commercial water rates in the previous section) and one base rate that were incorrect in the Town’s utility billing system. OSA also identified two sewer usage rate codes that were incorrectly entered from the rate increase in October 2023.

OSA calculated the amount that these accounts should have been charged for water and sewer service based on actual usage from October 2023 to February 2025.

For the period October 2023 through February 2025, the Town lost total revenue of $210,837 due to the negligent data entries.

In March 2025, the Town corrected the base rate in the system for commercial account codes A and B referenced above; however, they entered incorrect usage rates resulting in the previously mentioned commercial customers being grossly overcharged for their water usage.

For example: Business A (the same business above) paid an average of $17 for water service from July to September 2024, but in March 2025 they were billed $3,243 for water service.

This situation occurred due to negligent data entry and continued inadequate oversight during the implementation of the rate increases in the Town’s utility system. Proper oversight likely would have identified that the minimum and maximum water charge rates were set to the same amount and that the rates were input incorrectly into the Town’s billing system.

We Recommend the Following:

13. To reduce the risk of future fraud, the Town develop and implement policies and procedures regarding voided cutoff fees and proper segregation of duties.

14. The Town should develop and implement proper controls to ensure that rate information is correctly entered in the Town’s utility system.

Employee Timesheets: Allegation Unsubstantiated

Background

We received an allegation that an employee working at Town Hall inaccurately recorded the hours she worked on her timesheet.

OSA met with the Mayor and the Town Manager to understand the timesheet process. They explained that the Town lacks policies and procedures governing the authorization of timesheets for hourly employees and that supervisors do not consistently sign timesheets for hourly employees.

Finding

Based on a lack of policies and procedures governing hourly employee timesheets, OSA was unable to substantiate this allegation.

We Recommend the Following:

15. The Town should develop and implement policies and procedures related to the review and approval of employee timesheets, including, but not limited to, who is responsible for reviewing timesheets and how their review is documented.

MOUNT OLIVE’S RESPONSE:

Wi-Fi and Telephone Services

Town’s Response: The Town will review Wi-Fi and telephone invoices from the inception of the current contract with the Airport Operator and attempt to recoup any amounts that should have been the responsibility of the Airport Operator. The Town will also review their account history with the Wi-Fi provider to ensure proper credit was given for the $10,000 in payments made by the Town. A new contract is being drafted between the Town and the Airport Operator so that both parties are aware of their responsibilities regarding invoices for airport services going forward. The Town has already discontinued Wi-Fi service at the airport. Telephone lines have been reviewed and identified, and all unverified telephone services have been terminated. The Finance Officer will review and approve invoices for WiFi and telephone services to ensure that no services that are not the responsibility of the Town are paid for with Town funds.

Responsible Party: Finance Officer, Town Manager

Projected Completion Date: December 30, 2025

Aviation Fuel

Town’s Response: The Town will contact the fuel vendor to try to determine who authorized the drafts on the Town’s bank account and ensure that future purchases are made and paid by the parties as determined in the contract. A new contract is being drafted between the Town and the Airport Operator so that both parties are clear on their obligations for fuel purchases, commission payment amounts and other responsibilities for the airport fuel service.

A monthly reconciliation for fuel commissions will be prepared and signed off on by both the Town and the Airport Operator. Once the new contract has been signed the responsibility of preparation of the reconciliation will be determined and assigned to the party that purchases the fuel and will be sent monthly to the other party. The Town’s Finance Officer will ultimately sign all reconciliations monthly and verify that fuel commissions are paid properly to the receiving party. Reconciliations will be forwarded to the Town Manager.

The Finance Officer and the Airport Operator will have monthly meetings to discuss the revenue and expenditures for the airport. Those meetings will include the Town Manager for the first several months to make sure everyone has a clear understanding of their responsibilities regarding airport activities. The Town will ask the Airport Operator for semiannual reports at December 31st and June 30th showing revenue, expenditures, inventory status and commissions.

The Finance Officer will make sure bank reconciliations are made within 30 days of month end to ensure all transactions have been entered into the accounting system timely. The Town has discontinued paying for fuel while the new contract is being drafted. The Airport Operator will be responsible for purchases of aviation fuel going forward unless the new contract specifies otherwise.

Responsible Party: Finance Officer, Town Manager

Projected Completion Date: January 30, 2026

Town of Mount Olive Water Department

Town’s Response: The Town has reviewed the account in question, the rate schedule and the voided disconnect fees and agrees with the OSA findings.

In the future when rates are adjusted the new rate tables will be forwarded to the software vendor by the Finance Officer prior to the effective date of the increase. Rates will be updated by the software vendor and then printed, verified and signed off on by the Finance Officer. A copy will be forwarded to the Town Manager. There will be no access to rate tables by Water Billing Employees.

The Water Billing Supervisor will generate monthly batches for the application of late fees and disconnect fees. Batches are created by the Logics system based on predetermined settings for the application of late fees. Those fees are then batched to be reviewed for any fees that need to be voided before posting to customer accounts. Only the Water Billing Supervisor will be allowed to void fees and only when a written explanation for the voiding of a fee is provided. A list of voided fees and explanations will be forwarded to the Finance Officer for review and approval monthly. The Finance Officer will review the original batch in Logics to verify only the fees with an explanation have been voided. If a Town employee, sitting Town Commissioner or vendor has a fee voided the Finance Officer will forward the information to the Town Manager for additional approval.

A recommendation will be presented to the Town Board to pursue the collection of outstanding balance of all inactive accounts, including the accounts referenced in the Audit Report. It is also recommended that voided fees including disconnect fees and late fees be collected on the accounts referenced in the Audit Report as well as all other accounts that can be justified.

The Finance Officer will create a spreadsheet of water billing codes and will track the monthly totals for those codes to look for month-to-month variances. The Finance Officer will also update the water billing policies and include the above processes. She will present an updated draft policy to the Council for review and approval.

Recently the Town has hired a new employee in the water department that has experience in municipal government utility billing and billing through Logics.

North Carolina Rural Water Authority is in the process of conducting a rate study for the Town to determine if water and sewer rates are sufficient. The findings of that report will be shared with the Town Council to be used in determining any future increases.

Responsible Party: Finance Officer, Town Manager

Projected Completion Date: January 30, 2026

Employee Timesheets

Town’s Response: Time sheets are being updated so that they will be uniform. Department heads will be required to sign time sheets of the department employees. Time sheets will be reviewed by the Payroll Clerk. The Town Manager will review the timesheets at the request of the payroll clerk. Policies will be put in place to control overtime, comp time, and call back.

The town has purchased HR software and will work to put a program in place to better manage employee timesheets and records.

Responsible Party: Finance Officer, Town Manager, Department Heads, Payroll Clerk

Projected Completion Date: December 30, 2025

As of press time, it remains unclear what next steps — if any — will be taken, but Bell is calling for a townwide forensic audit.

And state officials confirmed to New Old North that they are turning over their findings to Wayne County District Attorney Matthew Delbridge, the man who will make the decision regarding whether to convene a grand jury in pursuit of potential fraud or embezzlement charges.

A loaded discussion

Fighting for their lives

Goldsboro loses a giant

“I’m a flippin’ hurricane!”

Public Notices — Feb. 22, 2026

Belting it out

Legendary

Final Four!