Work paused on Fremont school; WCPS wary of funding proposal

Wayne County Public Schools officials are delaying any further work on a plan to construct a new elementary school in Fremont while they review a proposal on how to fund it.

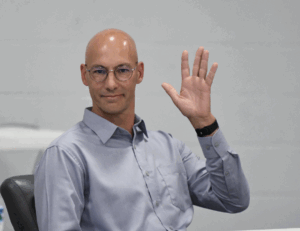

Acting Superintendent Dr. David Lewis spoke to members of the School Board’s finance and facilities committees Thursday to discuss a recent County Commissioners’ communication on how to cover the $5 million local match necessary to receive the $15 million in Needs-Based Public School Fund grant money for the project.

That plan includes a $4 million loan for which the school district would handle the debt service, and the transfer of about $1 million of $1,221,957 left in the county’s school funding account.

“(The commission said they) would borrow $4 million on our behalf and that payments on the loan could be stretched over 20 years,” Lewis said.

The debt repayment plan was proposed, in part, Wayne County Manager Craig Honeycutt said, to come up with a way to not only pay back the local match and to speed along the acquisition of funding, but to cover the impending loss of state lottery funds.

Under the Needs-Based grant agreement, Wayne County agrees to forfeit its lottery funds for five years — about $6 million total.

That leaves lost revenue in the county budget that Honeycutt says the commissioners have to account for — hence the funding proposal.

“We are trying to come up with other options for debt service,” he said.

Honeycutt says the proposal the commissioners sent to the school district is the beginning of a conversation, not the end.

“We have not drawn a line in the sand,” he said. “We were trying to be creative.”

Honeycutt said the commissioners and the school board will continue to talk about the local match, the lottery funds and the Fremont building project.

“There is still a lot of negotiating to be done,” he said.

Honeycutt said the commissioners understand the items on the district’s facilities “to-do” list are “pressing needs, not wants.”

He added that finding money to make those projects possible is on the county’s list.

“It will be a priority for the board to look at it at budget time,” Honeycutt said.

And on that list of discussion items is a change to the funding formula for the schools — and perhaps even a county property tax increase.

“Everything is on the table right now,” he said.

But Lewis said what concerns him — and other district officials — is a chart the county included with the county’s proposal, which suggested that the school district would not expect an increase in maintenance funding, which was listed at $2 million, through 2037.

The chart also indicated that anticipated increases in the available funding would mitigate the debt service expense, but that the district would not begin to realize any receipts that were not encumbered until 2025.

Lewis said that with rising employee costs and buildings that would still require repairs and maintenance, the county schools would simply be unable to cover its bills.

“We are struggling right now to maintain the facilities we have,” Lewis said.

Lewis added that the district is still paying on past projects, from Meadow Lane Elementary to other school improvements.

“There are projects that go back many, many years that we are still using designated funds for,” he said.

Assistant superintendent for support services Dr. Tim Harrell agreed.

Because certain funds can only be used for certain services, Harrell said sometimes money has to come from a non-encumbered account to meet the ever-increasing costs of salaries and benefits. That is a problem Harrell already addressed in discussions of the 2021-22 budget.

“The concern I have is to make sure we all understand where our funding sources come from,” Harrell said.

If too much money is tied up in debt service, that means there will be no funds for repairs and other jobs that have to be accomplished to keep the school buildings operational once the district’s required obligations for staff are paid.

And that debt percentage is important, Lewis said.

He suggested that the district is currently utilizing 75 percent of its lottery funding for debt service, which creates the vicious circle of patching buildings rather than making the big purchases that solve the problems. Adding an additional bit of debt service, especially taking into account the district’s current financial concerns, would increase that percentage significantly, Lewis said.

“We are going to be right back here year after year,” Lewis said. “You are talking about us crippling ourselves when it comes to maintaining our buildings.”

Board member Jennifer Strickland said the reductions in the maintenance fund (which leaves about $1 million available) — mean that big ticket projects like roof replacements (which can run more than $1 million) just are not feasible.

“We are in a patch-as-we-go mode already,” Strickland said.

School board chairman Chris West said when he and other board members agreed to apply for the state grant funds last fall, there was no mention of the debt service plan. The county signed a statement that the money for the local match was available and ready.

“We would have looked at this a little different had we known we were going to have to fund this whole project,” West said.

Board attorney Richard Schwartz advised the board privately during an executive session, but commented publicly during the committee meetings that finding common ground with the commissioners should be the goal.

“You are looking at $15 million from the state,” he said, adding that even with the lost lottery funds, the county would still net $9 million.

“It is a big chunk of change,” Schwartz said. “Working out a solution is in everybody’s self-interest.”

Honeycutt said the county commissioners and the school board have had several productive conversations and that he expects that cooperation to continue.

A loaded discussion

Fighting for their lives

Goldsboro loses a giant

“I’m a flippin’ hurricane!”

Public Notices — Feb. 8, 2026

Belting it out

Legendary

Final Four!