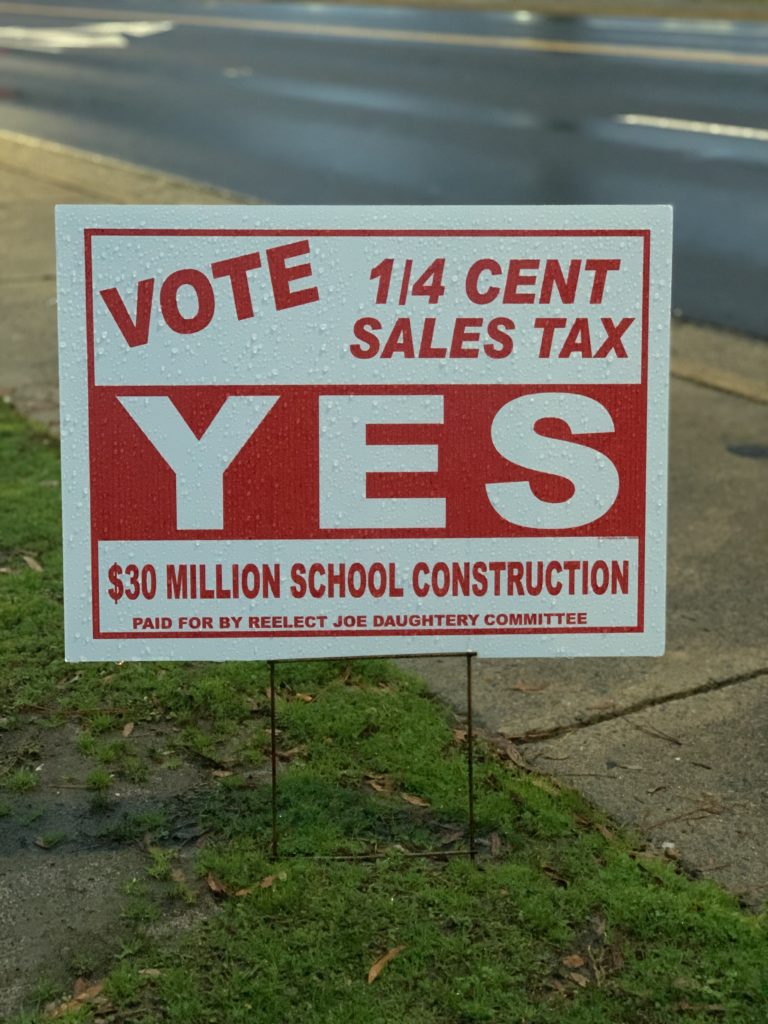

Vote yes, but don’t forget how we got into this mess when you head to the polls

We get it.

You are sick of writing checks to governments, school boards and every other Tom, Dick and Harry.

And we bet that you, like us, are not at all surprised that we can count on about three fingers the number of times one of those entities said, “Gee, we have too much money. Here’s some back.”

So, we also get that when you heard Wayne County commissioners and school board members came up with a way to fund infrastructure improvements in the county schools, you were way more focused on what came next, not the “historic” agreement from the usually feuding factions.

The proposal includes a quarter-cent sales tax increase.

<Alarm bells sound.>

Here we go again.

But this time, it’s different.

Historically, when it comes time to fund plans like these, property owners shoulder the brunt of the burden.

Property taxes go up, and the projects are financed.

The problem is, there is only so much taxation these property owners can and should tolerate — so improvements are made piecemeal and not in a timely manner.

And that is how we got here.

There are real issues in Wayne County’s school buildings — and they are there because the repairs, the construction, the improvements that were necessary were passed on to another year, another budget, another debate.

The scuffles over funding between the commission and the school board, about everything from facilities to supplements for teachers, are legendary — and have been a part of every budget season in recent memory.

But this proposal is a bright spot — a sign that this time might be the one when the needs of the teachers and students in WCPS take precedence over the turf wars.

And this is not about building the Taj Mahal, either. The plan will get us to where we need to be and provide the kind of facilities our students deserve and those who might consider investing in this community expect.

It will keep our students — and the men and women who educate them — safe.

It will also help us avoid paying our superintendent’s salary, the penalty that would be inflicted by the state as punishment for overcrowding classrooms.

So yes, a quarter-cent sales tax increase is the fair way to accomplish this goal.

Sure, we could gripe about what should have been done to avoid this — and at some point, we will — but that won’t help us accomplish the mission at hand.

At least this way, the burden is spread around, ensuring everyone would contribute to building the facilities their families use.

That is exactly how it should be.

Look, tax increases are no fun. None of us are jumping up and down, no matter how small the hike is.

But the truth is, this is not a lot of money and absorbing this increase will mean very little sacrifice for most local families.

And it’s worth mentioning that those who live elsewhere, but who shop here, will contribute, too.

So here’s the bottom line: Taking care of the schools in our community is our responsibility. We need to step up.

This is a reasonable and necessary plan.

But let’s be clear about something else, too. That doesn’t mean we will write a blank check.

And we will scrutinize every penny being spent.

Careful planning and research are critical to this project being a benefit rather than a boondoggle.

No good-old-boy contracts. No wasteful spending. No Taj Mahals. No more bickering and wasted time.

Leave the egos at the door and put the kids first.

That will be the challenge facing commissioners and school board members in the months ahead.

And at some point, we need to talk about how we got here — and, more importantly, who got us into this mess in the first place.

We need to hold our elected officials responsible for not doing the right thing by our children and teachers.

And luckily, we will have an opportunity to have those discussions ahead of critical elections for seats on both of those boards in the coming weeks and months.

Trust us. The things that have needed to be said for years will be said.

But now is not the time for that — not when we have overcrowded classrooms and principals wasting valuable time trying to help WCPS avoid a significant financial penalty.

Today, we need to support the quarter-cent sales tax increase that would fund our way into the future our educators and their students deserve.

Then, we work to ensure we never have to do so again.

A loaded discussion

Fighting for their lives

Goldsboro loses a giant

“I’m a flippin’ hurricane!”

Public Notices — Feb. 8, 2026

Belting it out

Legendary

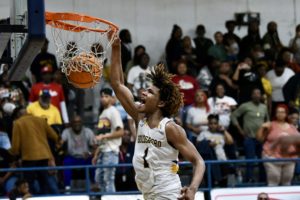

Final Four!